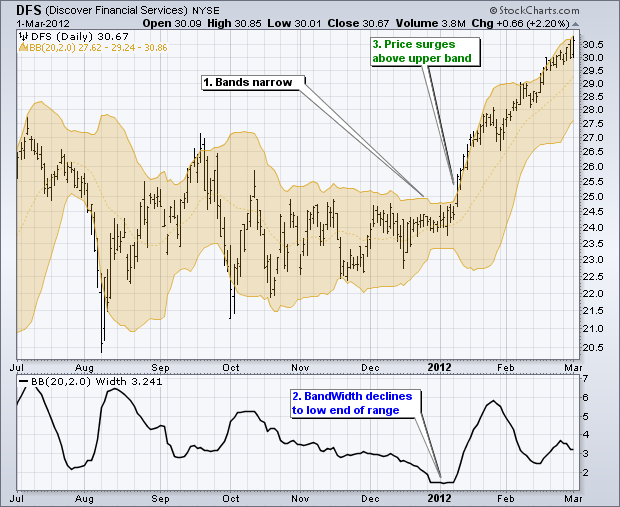

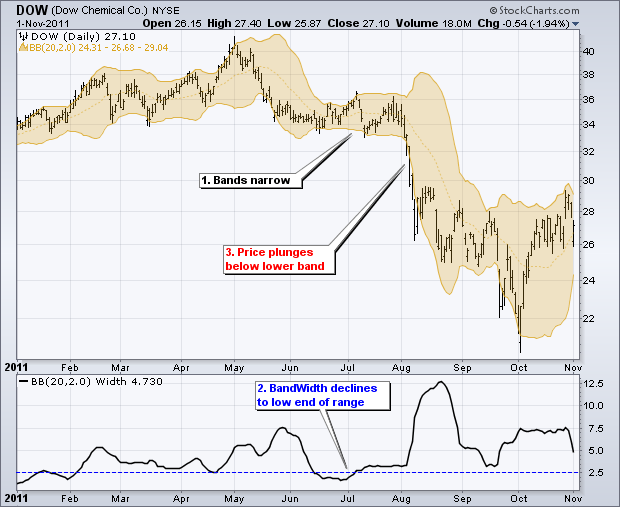

The Bollinger Band Squeeze is a straightforward strategy that is relatively simple to implement. First, look for securities with narrowing Bollinger Bands and low BandWidth levels. Ideally, BandWidth should be near the low end of its six-month range. Second, wait for a band break to signal the start of a new move. An upside bank break is bullish, while a downside band break is bearish. Note that narrowing bands do not provide any directional clues. They simply infer that volatility is contracting and chartists should be prepared for a volatility expansion, which means a directional move.

BandWidth Signal Recap:

- Bollinger Bands narrow on the price chart.

- The BandWidth is near the low end of its six-month range.

- Price breaks above the upper band or below the lower band.