What is leverage?

As we’ve discussed previously, one of the characteristics of spot forex is the ability to trade using financial leverage. But what exactly is leverage?

Using financial leverage

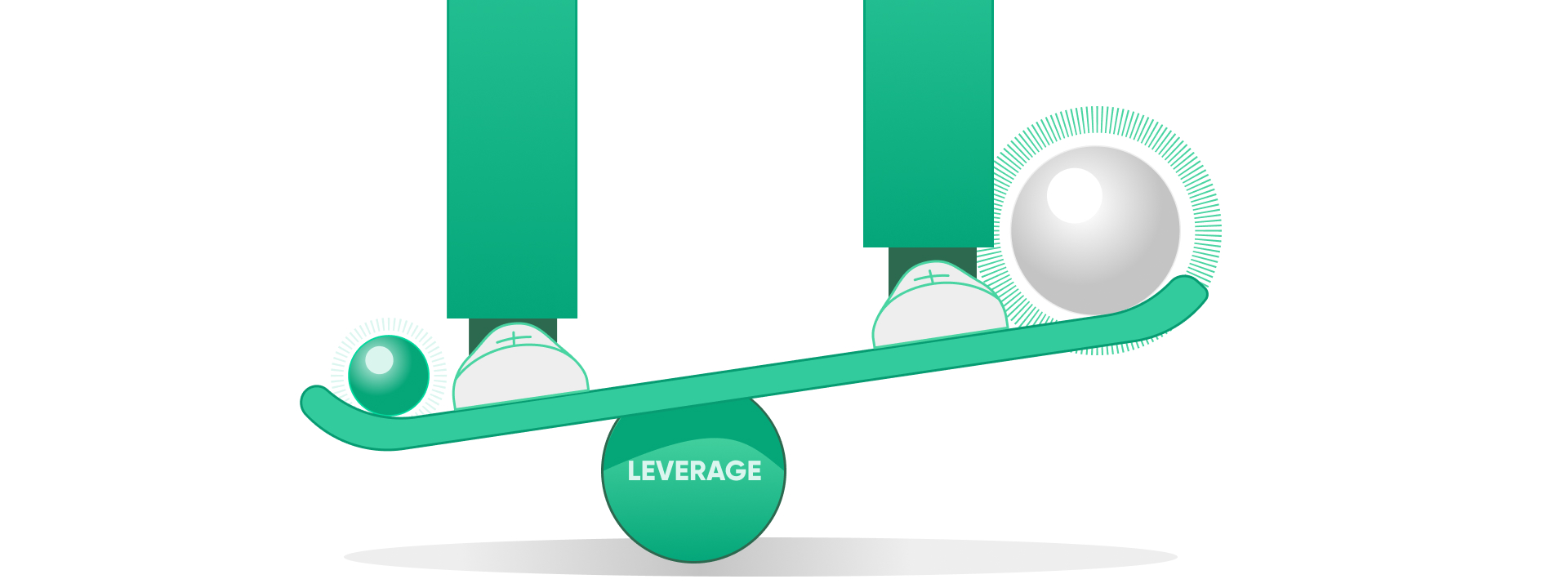

Essentially, financial leverage acts as a multiplier, allowing you to control larger positions on the market with less of your own money.

Leverage is expressed as a ratio. 1:1 means no leverage, while values like 1:20 imply you can control a position 20x larger than the money you deposit. When trading spot forex, the amount of leverage available to you is determined by the NFA and the CFTC, based on the liquidity and risk profile of each currency pair, but can be lower depending on the current market conditions.

Let’s say, for example, that you had deposited $100 and were looking to trade USDCAD. For this currency pair, the leverage available is 1:50. This means that, with your $100, you’d be able to place a trade worth up to $5,000, or 50x your deposit.

It’s important to note that, although leverage can help you start trading with less money and can increase the size of any potential profits, it can also result in greater losses. There are risks involved and these must be understood and managed correctly.