What is margin?

Now that you’ve understood the concept of financial leverage, let’s take a look at margin. Leverage goes hand in hand with margin, in fact, trading with leverage is often referred to as trading on margin. So, what exactly is margin and how does it play into your trading?

How margin affects trading

Margin is the money you need to have in your account to open a trade using leverage. It is usually expressed as a percentage of the overall size of your trade.

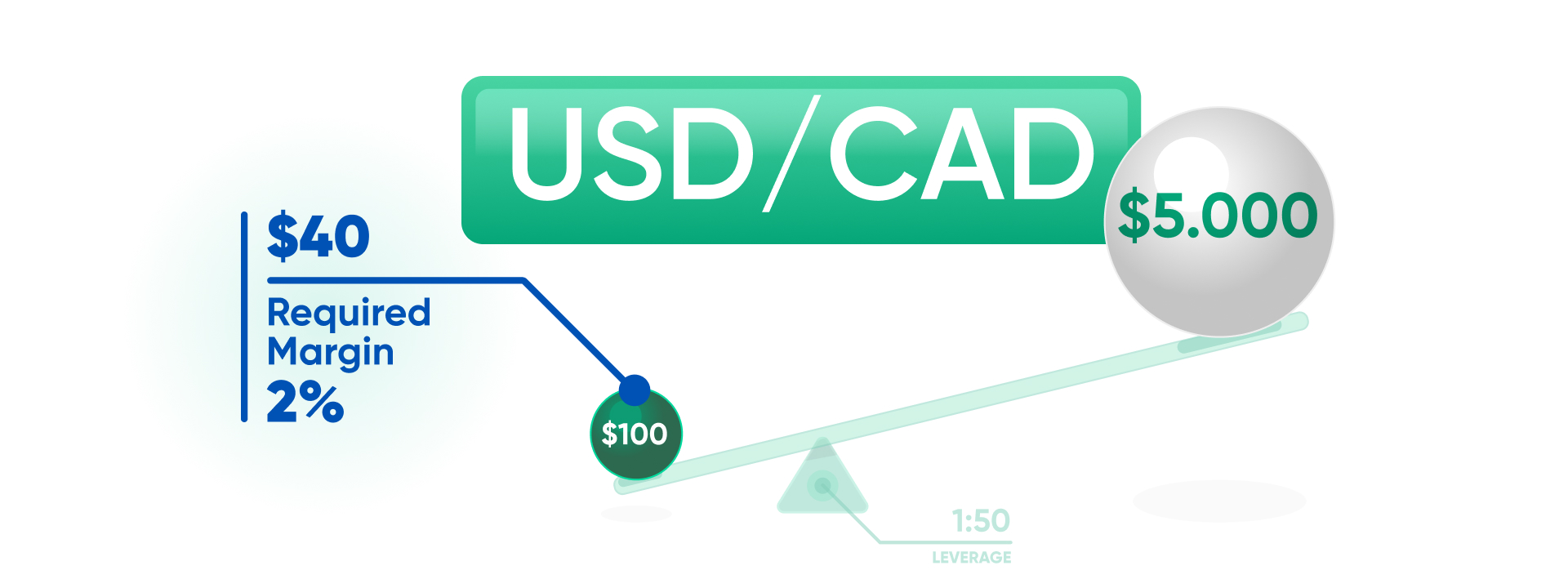

Going back to our example from earlier, when trading USDCAD at leverage of 1:50, your $100 deposit allows you to control a position worth up to $5,000. Now, let’s say you wanted to buy $2,000 worth of USDCAD. In this case, the margin required to open this trade would be 2%. So, $40 of your original $100 would be set aside. This is known as required margin.

Of your original $100, the $60 remaining could be used to open a new position or maintain your existing trade if the market moved against you. This is known as free margin. The free margin you have available is affected by the profit and loss from your open trades, as well as daily rollover fees, all of which directly impact the funds in your account.

Margin alerts and stop outs

As mentioned previously, trading on margin comes with a certain degree of risk. You need to be wary of what happens if the market turns against you and understand how to manage it. That’s where margin alerts and stop outs come in.

Margin alerts

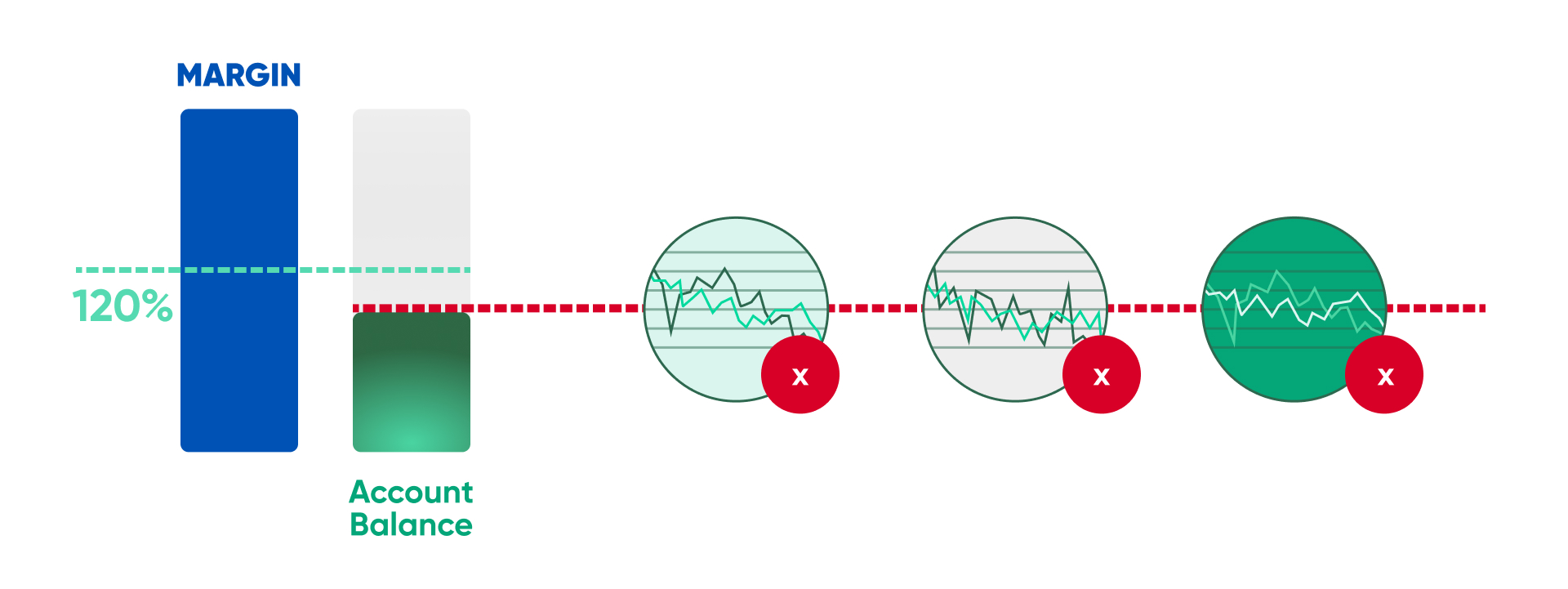

A margin alert is a notification you may get when the money in your account falls below a specific level.

If things aren’t going your way and your funds decrease to a point where they can no longer cover the required margin for your trades, you’ll get a margin alert.

This is a courtesy notice we provide to all our customers within our platforms, to help you make sure you have adequate free margin to protect your positions against adverse market moves.

If you receive a margin alert, you may wish to deposit more money or reduce your open positions to protect your account.

Stop outs

Also referred to as a margin closeout, this is when your positions are closed automatically because the money in your account falls below a certain level.

With Trading.com, this happens when your funds fall below 100% of the required margin.

When this happens, we automatically close your open positions, starting with the position incurring the largest loss. This policy is in place to protect your account from realizing even greater losses.