What is the spread?

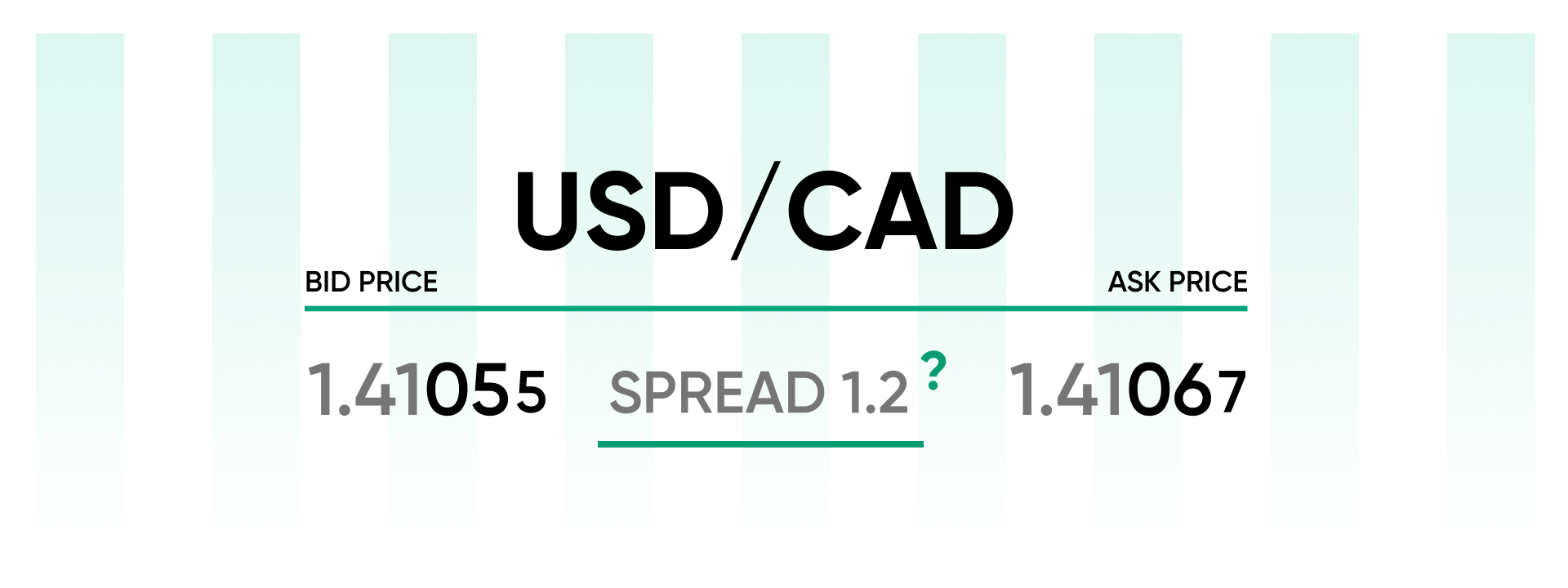

As we’ve mentioned before, forex brokers always quote two prices for currency pairs. The bid or sell price and the ask or buy price. The ‘bid/ask spread’, more commonly referred to as just the ‘spread’, is the difference between these two prices. But why is it important?

Market liquidity and the cost to trade

For the most part, the spread is a measure of market liquidity and the cost to trade a pair. During times of high liquidity, spreads will be lower. Conversely, when liquidity is low, the cost to trade will be higher.

To explain this further, let’s compare USDCAD, a major currency pair, to USDZAR, an exotic currency pair. Due to high market liquidity, in other words, large trading volumes on the pair, the spread on USDCAD can often be as low as 1.2 pips. Whereas, when it comes to USDZAR, which has lower trading volumes, the spread can often reach 100 pips!

With this example, we can see why USDCAD is classified as a major pair and USDZAR as an exotic. It also clearly demonstrates the effect market liquidity has on the cost to trade a pair, with the exotic being a lot more expensive.

How do spreads relate to transaction costs?

To understand how spreads relate to transaction costs, we need to return to something we covered earlier; pip value.

If you’ve read through our What are pips and lots? article, you’ll remember that to calculate the value of one pip, we can use the following equation:

Pip value = (1 pip / exchange rate) x trade size

So, sticking with USDCAD from our example above, how much would 1 pip be worth if you wanted to trade 10,000 units and the pair’s exchange rate was 1.41065?

Pip value = (0.0001 / 1.41065) x 10,000 = 0.7

Each pip would be worth 70 cents. So, if the spread for USDCAD was 1.2 pips, it would cost you 84 cents to open this trade.

Now let’s take a look at USDZAR. How much would it cost to open a 10,000-unit trade on the pair if its exchange rate was 17.14165 and the spread was 100 pips?

(0.0001 / 17.14165) x 10,000 = 0.06 => 0.06 x 100 = 6

It would cost you $6 to open this trade, more than seven times the amount of the USDCAD trade!