Forex, short for foreign exchange, is the conversion of one currency into another.

In the past, forex trading was conducted mainly by large institutions and high-net-worth individuals, due to the costs involved. However, rapid advances in technology over the last decade mean that almost anyone can now trade on currencies from the comfort of their own home.

As online trading has become more and more accessible, the term forex has been propelled into the public domain.

The foreign exchange market

Whether you realize it or not, you’ve likely already participated in the forex market.

Have you ever exchanged currencies at a bank before going on holiday? Then you’ve experienced foreign exchange! Granted, actively trading forex online differs slightly, but the basic concept remains the same.

How are currencies traded?

But how exactly are currencies traded on the forex market?

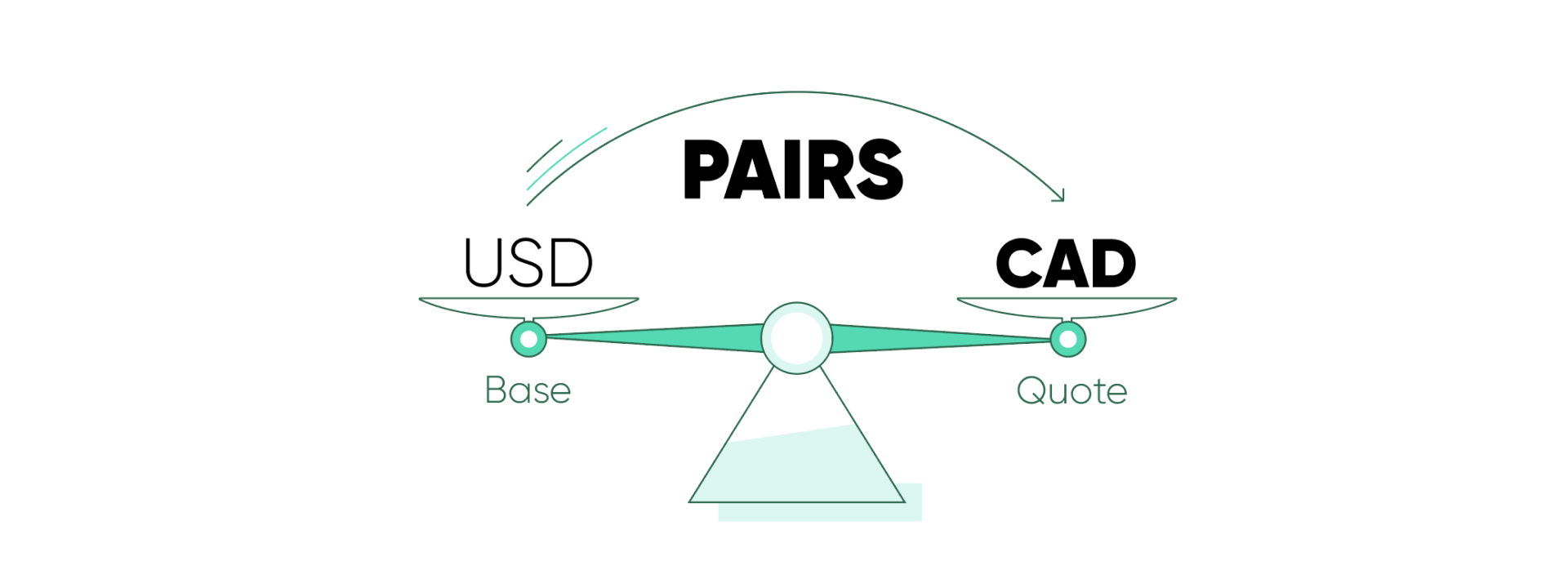

Interestingly, currencies are traded in pairs. This means that, when you buy one currency, you’re simultaneously selling another.

Let’s take the USDCAD currency pair as an example. If you were to buy the pair, you’d simultaneously be buying U.S. dollars and selling Canadian dollars. The opposite would be true if you were to sell the pair.

Why do people trade currencies?

There are two main reasons why people or businesses trade forex; speculation or commercial trading.

Speculative trades are by far the most frequent on the forex market and make up most of the daily volume. These trades are placed simply to profit from changing currency prices. The sheer number of speculative trades placed daily means that volatility in the forex market is always high, creating more opportunities, but also providing added risk.

Whenever an exchange of goods or services takes place between companies in different countries, forex must come into play. This is known as commercial trading. Although a massive amount of commercial trades take place on any given day, the amounts exchanged are minimal when compared to the overall market volume.