What are the bid and ask?

When trading forex, brokers will always quote you two prices; the bid and ask. This might be confusing if you’re used to other markets, like the stock market, where you’d buy company stock for a specified price. So, what exactly are the bid and ask?

Buying and selling

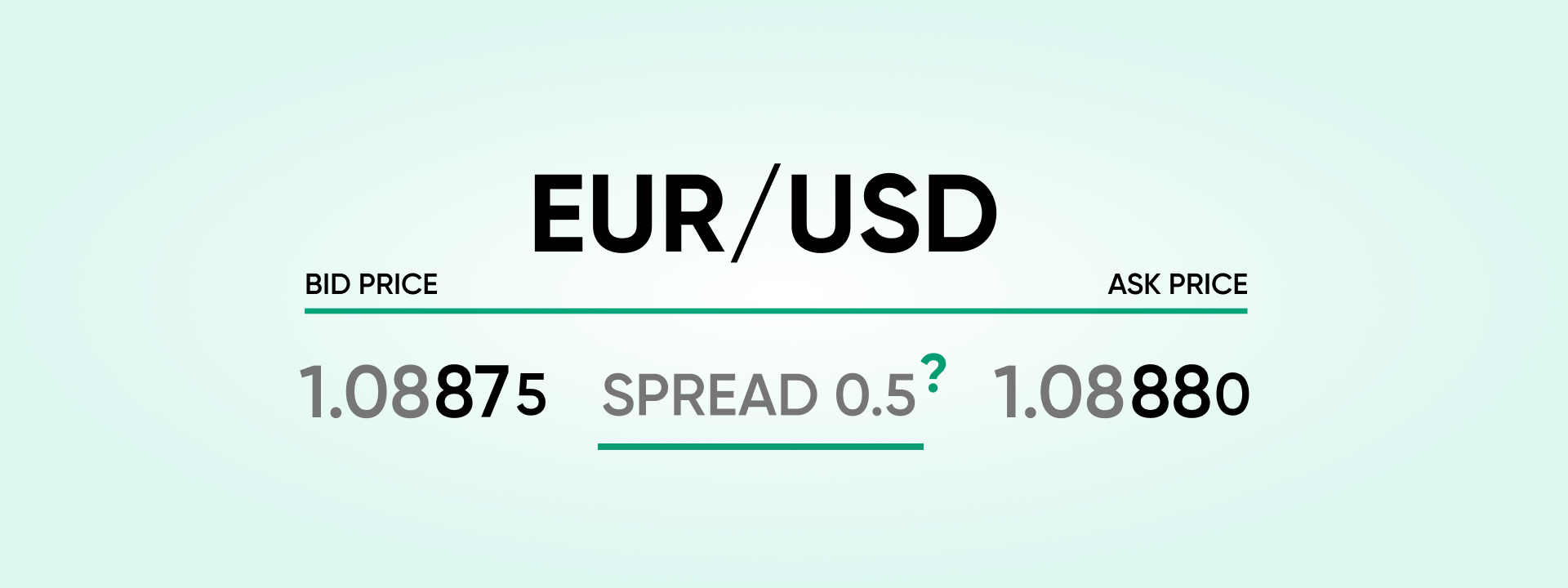

The bid is the maximum a buyer on the forex market is willing to pay for a currency pair. Essentially, it’s the price you can sell the base currency at.

The ask is the minimum a seller on the market is willing to accept for a currency pair. In other words, it’s the price you can buy the base currency at.

It’s important to note that the ask will always be higher than the bid.

The difference between the bid and the ask is known as the spread, but more on that later.

How prices are shown on trading platforms

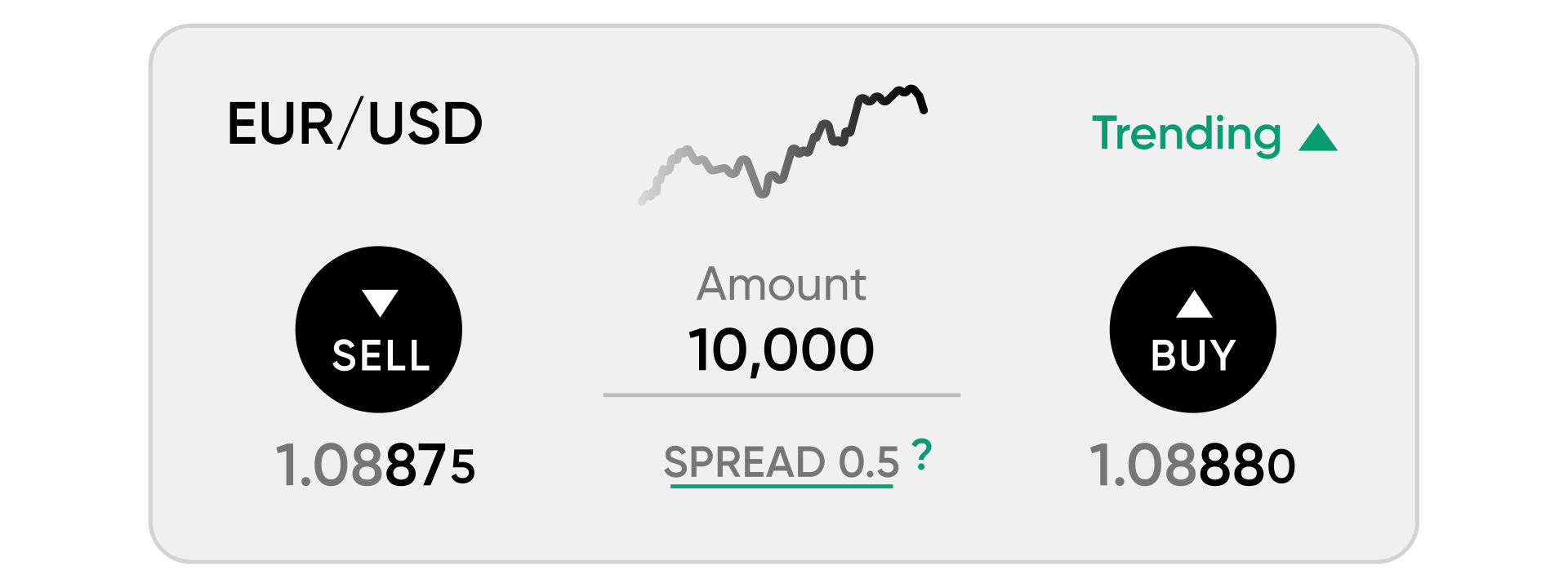

To avoid confusion, brokers often choose to display ‘Buy’ and ‘Sell’ on their trading platforms, rather than ‘Ask’ and ‘Bid’, something we do at Trading.com.

This way, the pricing is clearer, making it easier to understand which is the price to buy a currency pair and which is the price to sell it.

It also means that traders don’t have to recall the terminology bid and ask, avoiding any mishaps that might occur when trading in the heat of the moment.

It’s also worth noting that, on most trading platforms, only the ‘Buy’ or ‘Ask’ price is shown by default on the charts. To see the ‘Bid’ or ‘Sell’ price, traders must enable this setting from the chart options.