What is an order?

So, you’re ready to place your first trade. That’s great, but how exactly do you do it? You need a way to convey all the relevant information about your trade, so that it can be executed on the market. In spot forex trading, this is known as ‘placing an order’.

What order types are there?

There are various order types available, helping traders adapt to any situation. Most commonly, there are ‘market orders’, which execute a trade immediately, and ‘pending orders’, which will only execute if certain conditions you set are met.

Market order

This is the most common type of order and the most basic.

If you want to open or close a trade immediately by buying or selling a currency pair, a market order is the way to go. Once placed, your order will be executed at the best price available.

Limit order

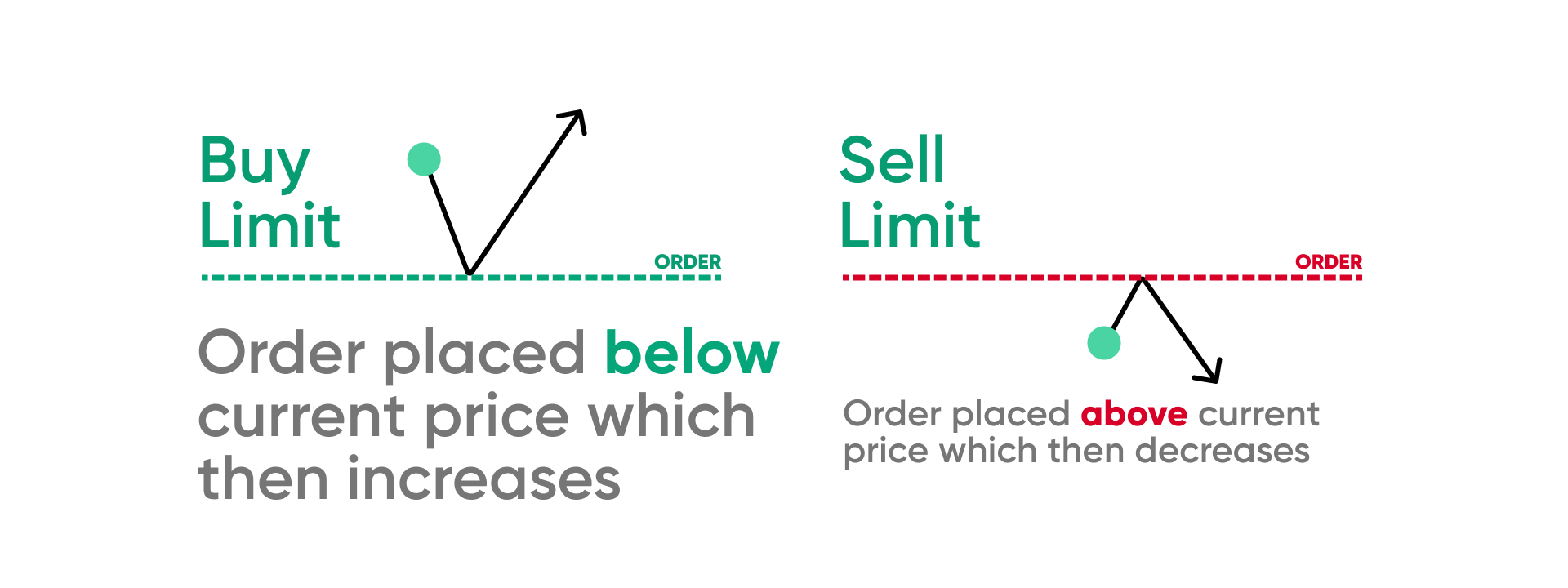

This is a type of pending order that only executes at a price you choose or better.

- a sell limit order sells a currency pair at a set price or higher

- a buy limit order buys a currency pair at a set price or lower

You’d use a limit order if you thought a pair’s price was likely to reverse after hitting the price you set.

Let’s say EURUSD was trading at 1.13758 and you wanted to buy the pair when it reached 1.13658 because you expected a reversal. You could wait for the price to go down and place a market order, or you could place a buy limit order. Once the price reaches 1.13658, your trade would execute automatically at the best available price.

With limit orders, if the price you set is never reached, your trade will not be executed. To manage this, you can set the duration of your order. Options include keeping the order open until you cancel it (Good Till Cancelled) or until a certain date (Good Till Date).

Stop order

This is a type of pending order that only executes if the price you set is reached. Also known as a stop-loss order, it’s often used to manage risk when trading.

- a buy stop order buys a currency pair at a set price

- a sell stop order sells a currency pair at a set price

Continuing our earlier example, let’s say you bought EURUSD at 1.13658, but want to limit any potential losses in case the reversal doesn’t happen. You could place a sell stop order anywhere below 1.13658 to protect yourself. That way, if the price were to fall further, your sell stop would trigger, closing your trade automatically.

Remember, stop orders execute at the best available price depending on market conditions. They also aren’t guaranteed to execute as, during times of high volatility, slippage can occur which can cause the market to move past your stop level without triggering it.

At Trading.com, we’ve tried to simplify the process for placing pending orders. We define your order type based on your inputs, so you don’t have to remember which is a limit and which is a stop order. For example, if you want to buy a currency pair and enter a price below the current market price, your order will automatically become a buy limit order.