How does leverage work?

Now that we’ve covered the basics when it comes to what leverage and margin mean, let’s see how they work using some more detailed trading examples.

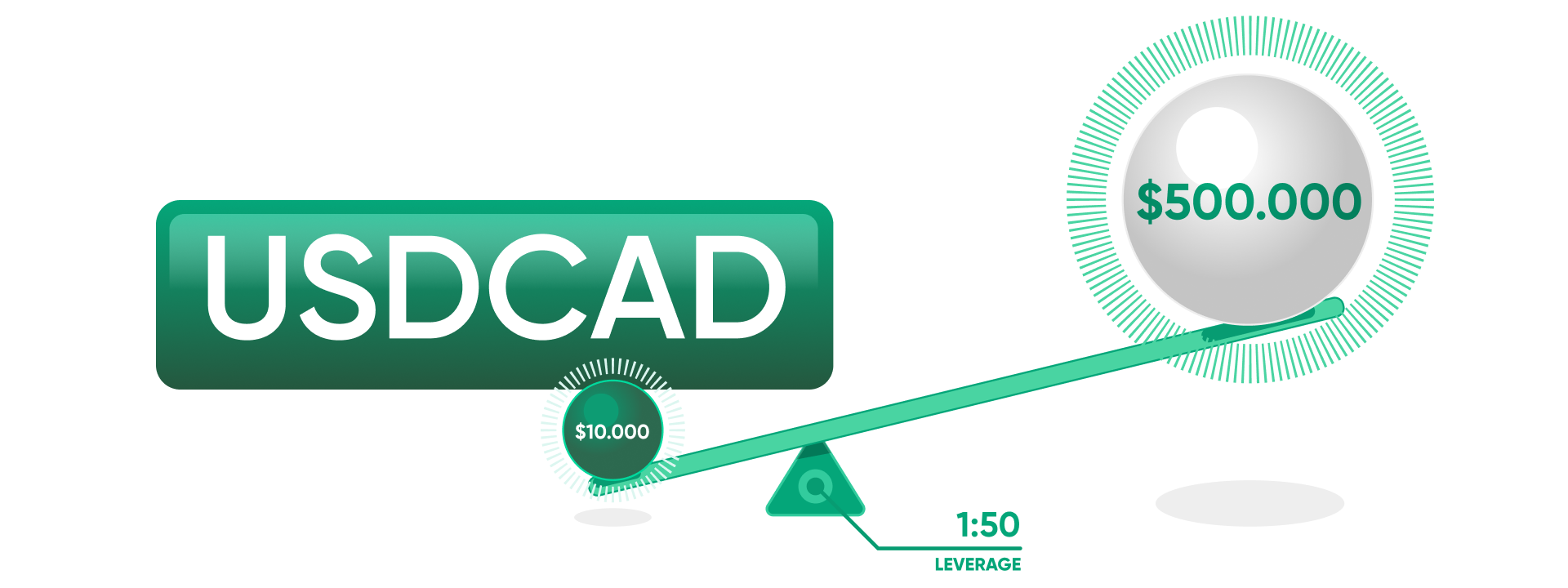

Forex leverage example #1 – Buying USDCAD

Let’s say you want to open a long position on USDCAD and you currently have $10,000 in your account, with no open trades. When trading this pair, you’d have leverage of 1:50 and therefore a margin requirement of 2%. Based on your leverage, you’d be able to control a position worth up to $500,000.

You decide to buy $200,000 of USDCAD which is trading at 1.35341. $4,000 of your initial $10,000 is set aside as required margin. The pip value for this trade would be $15 (Pip value = (1 pip / exchange rate) x trade size).

Imagine USDCAD rises in value by 100 pips to 1.36341. You close your trade, netting a tidy profit of $1,500. From a single trade, you have made a return of 15%.

This is of course just an example and excludes any costs or fees that would be associated with your trade, such as spread or rollover. However, it is a good demonstration of the benefits of leverage. Without it, you would have had to put up all $200,000 yourself. Alternatively, you could have just traded your $4,000, and your profit would have been $30, a return of only 0.75%.

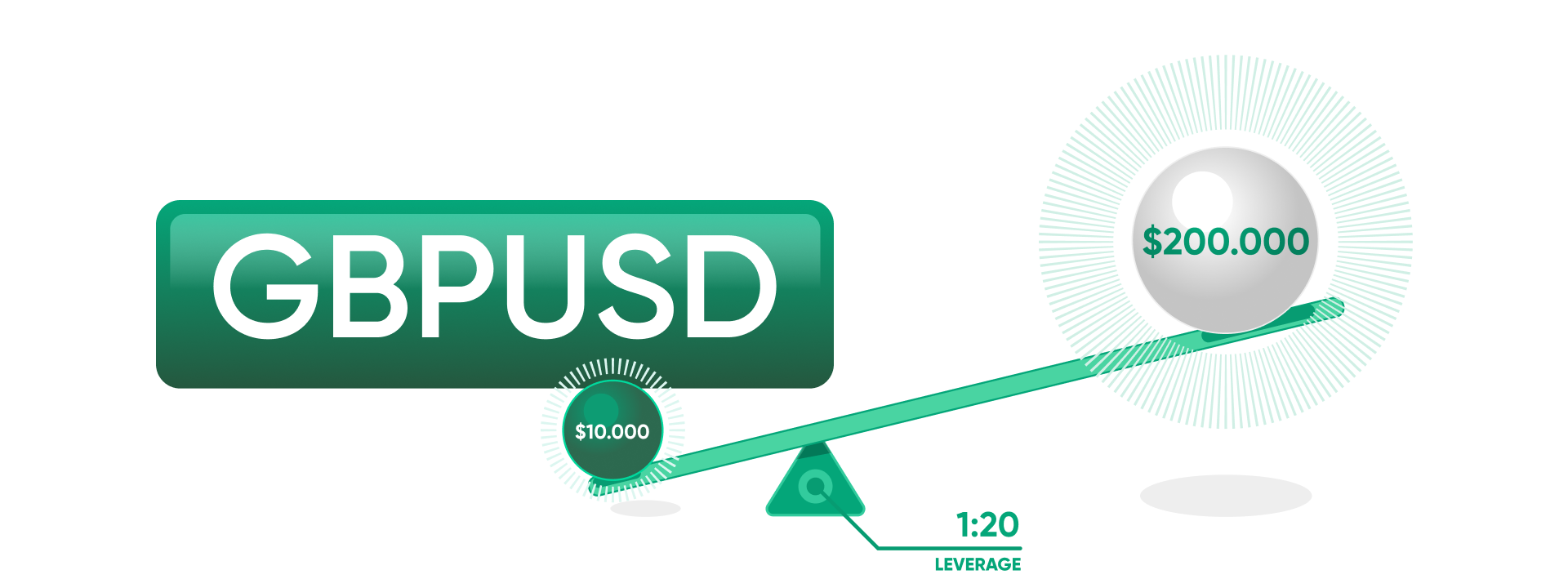

Forex leverage example #2 – Selling GBPUSD

As we’ve discussed before, leverage is a double-edged sword. So, now, let’s look at an example where things don’t go your way.

You start with the same $10,000, but this time you want to sell GBPUSD. For this currency pair, the leverage available is 1:20, and the required margin is 5%. This means you’d be able to control positions worth up to $200,000.

You decide to sell $100,000 worth of GBPUSD at 1.26340. The required margin for this position would be $5,000. In this case, the pip value would be $10 (Pip value = ((1 pip / exchange rate) x trade size) x exchange rate).

The market moves against you, with GBPUSD rising by 100 pips to 1.27340. You close your trade, taking a loss of $1,000. This time, a single trade has cost you 10% of your account balance.

So, although leverage can help increase your profits, it can also multiply your losses, especially if your account is underfunded. Without good risk management, you could lose all your money from even the smallest market movement.