The pros and cons of leverage

Do you feel like you now have a good understanding of leverage, margin and how they work? Are you sure? Good. Because before even thinking about trading spot forex, you need to be completely comfortable with these topics. You may remember us referring to leverage as a double-edged sword. Now it’s time to explore what we mean by this in a little more detail.

The benefits of trading on margin

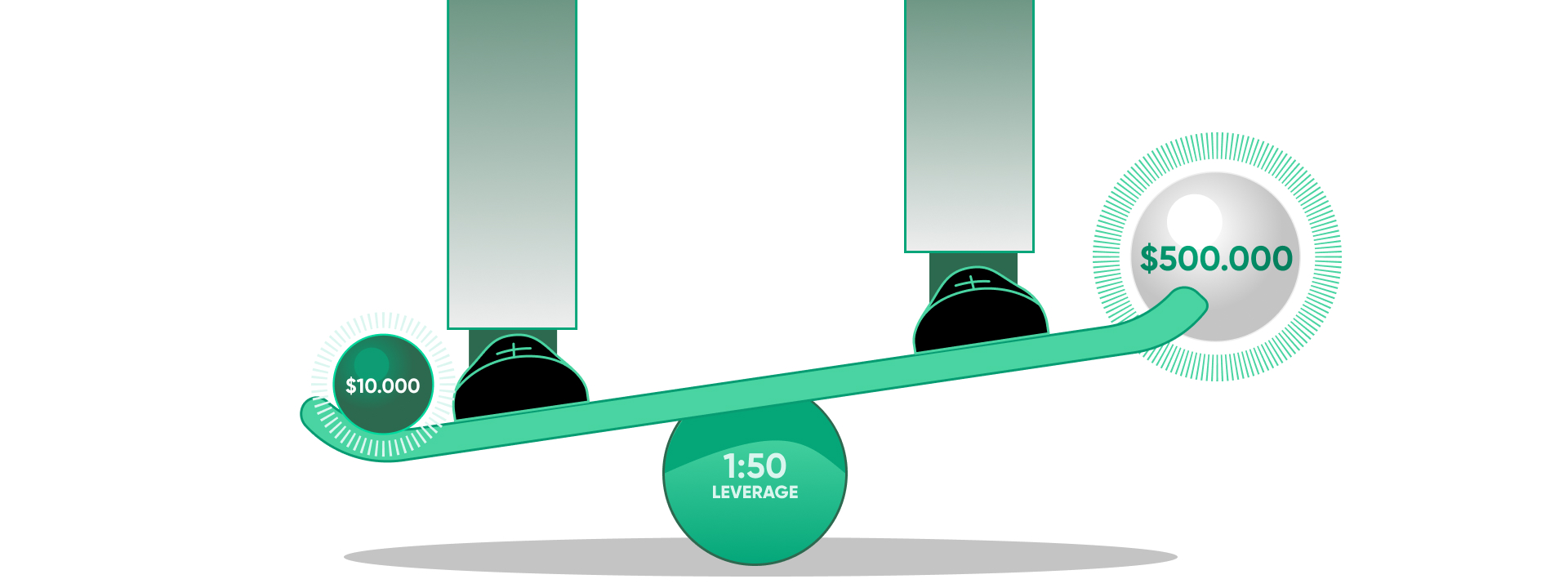

One of the things traders find appealing about forex is the ability to use leverage or trade on margin.

Due to advances in technology and the availability of leverage, more traders than ever before now have access to the currency market. In the past, foreign exchange was mainly conducted by banks and major corporations, due to the high amount of starting capital needed to invest. The ability to trade on margin allows traders to enter the market with as little as $50.

Leverage can also amplify any profits traders may earn, as it allows them to control larger market positions with less money. So, the return from a profitable trade would be higher than if it had been placed without leverage.

The risks of financial leverage

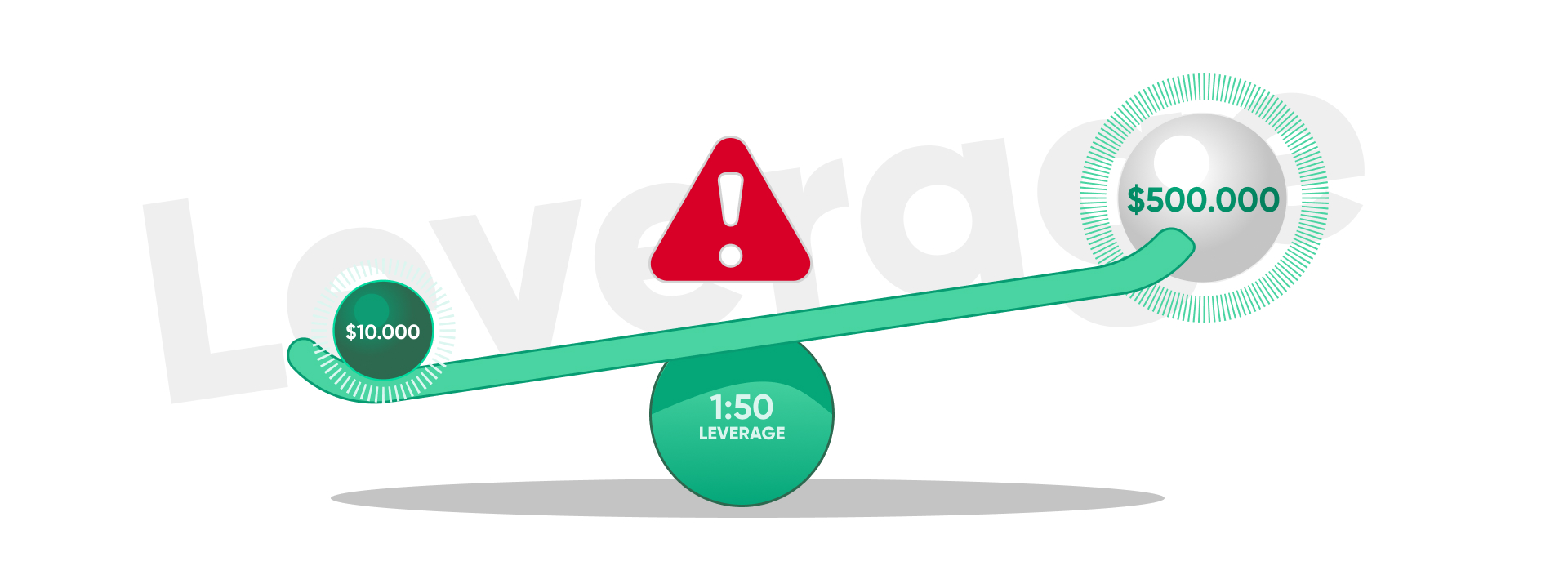

It’s important, though, not to look at financial leverage through rose-tinted glasses. In other words, don’t focus simply on the benefits. As with everything in the world of trading, leverage comes with risks.

Yes, trading on margin can amplify profits, but it can do the same for losses. When controlling such large market positions, even the smallest movement in an unfavorable direction can have a significant impact on traders’ account balances.

Additionally, although it’s possible to enter the market with as little as $50, that doesn’t necessarily mean traders should do so. There is a delicate balance that must be found between available capital, leverage and trade size. Being undercapitalized, overleveraged or, even worse, both, is something traders need to avoid at all costs. In such situations, even the smallest market movement can lead to a margin call or stop out, resulting in positions being closed automatically. Traders must also keep track of added costs like rollover fees, when trading on margin. Failing to do so can lead to an undermargined account, even if their trades make a profit.

That’s why a thorough understanding of leverage and margin is so important. As is having a sound risk management strategy in place before trading – something we’ll cover in more detail later.